Calculate my borrowing power

Calculate your mortgage capacity in minutes and get your personal mortgage report for free. In the status tray right-click the License Borrowing icon.

Loan Calculator Credit Karma

Should you pay Lenders Mortgage Insurance buy a home now or save for a bigger deposit.

. Offset calculator Use this calculator to estimate how much sooner you could pay off your loan and how much interest could you save on your loan over time by using an offset sub-account. Rates and repayments are indicative only and subject to change. There are special words used when borrowing money as shown here.

The best way to find out is to chat to a Home Lending Specialist who can give you a better idea based on your circumstances. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan. See what your repayments are like what your borrowing power is even calculate your stamp-duty.

Values required an array or a reference to a range of cells representing the series of cash flows for which you want to find the internal rate of return. Calculate my borrowing capacity Find out if you are eligible for a loan. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk.

Get the estimates you need for buying your home. 24 x 35 84 cents per hour. How much can I borrow.

If you are unsure you can use 35 cents per kWh for electricity. One of the best places to start the process and to help you work out where you stand is to use our online calculators. Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan.

Use our buy now or save calculator to compare options. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Click Help About.

Divide 2400W by 1000 24kW. What is your borrowing capacity. With compounding we work out the interest for the first period add it the total and then calculate the interest for the next.

It should be provided as a percentage or corresponding decimal number. Retirement can be the happiest day of your life. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years.

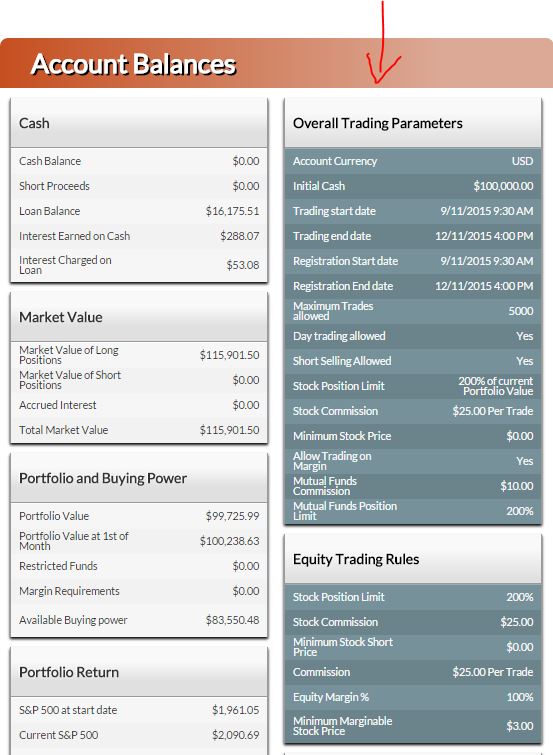

Disclaimer - Borrowing power. John and Janes expenses Our hypothetical couple are 30-year-old newlyweds John and Jane. The borrowing amount is a guide only.

Try our Borrowing Power Calculator and find out how much the banks will lend you for your home loan. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. Find out your actual borrowing power.

Weve assumed a 250 interest rate and a 30-year loan term. If necessary convert input power to kW. 1100 now and is still using my money I should get more interest And so this is the normal way of calculating interest.

Guess optional your guess at what the internal rate of return might be. An interest rate refers to the amount charged by a lender to a borrower for any form of debt given generally expressed as a percentage of the principal. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

If omitted the default value of 01 10 is used. Get your individual home buying plan. Learn how to improve your chances of getting a loan.

You can also use our How much can I borrow calculator to determine your borrowing power. Check your bill for your energy tariff rate - the amount you pay per unit of electricity. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook.

What is an Interest Rate. This is called your borrowing power. This will help you get a better idea of what.

Enter RETURNLICENSE on the command line. In the About window click Product License Information. It is called compounding.

Click Tools License Borrowing Return License Early. Buy Now Or Save More Calculator. The asset borrowed can be in the form of cash large assets such as vehicle or building or just consumer goodsIn the case of larger assets the interest rate is commonly referred to.

LVR is important because it may affect your borrowing power. This calculator helps you work out the most you could borrow from the bank to buy your new home. Instantly calculate what your repayments will be depending on how much you borrow the interest rate on the loan and the repayment frequency.

The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator. However whether this improves or adheres your borrowing power will depend on many things like whether the property is positively or negatively geared the property value and your current loan. Retirement Savings Calculator Am I saving enough for my retirement.

You can use a loan repayment calculator to try similar calculations based on your needs. M equals your monthly payment. What is the value of my business.

In the Product License Information window click Return License and then Yes. The standard formula for calculating a monthly mortgage payment is M Pi1i to the nth power divided by 1i to the nth power-1. Click Return License Early.

All these calculators and more are right here for you. Borrowing power calculation does not constitute a loan offer. It doesnt take into account loan eligibility criteria or your complete financial position.

Generally the lower the LVR the better as it carries less risk for the lender. Multiply the input power by the energy tariff to calculate the hourly running cost. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding.

For instance if youre borrowing 400000 to buy a 500000 property your LVR would be 80 because 400000 is 80 of 500000. We have also made a number of assumptions when estimating your borrowing power and those assumptions affect how reliable this estimate is.

Borrowing Power Calculator Sente Mortgage

Mortgage Calculator How Much House Can You Afford Finder Com

How Is My Buying Power Calculated Personal Finance Lab

5 Best Mortgage Calculators How Much House Can You Afford

Mortgage Calculator Money

Lvr Borrowing Capacity Calculator Interest Co Nz

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

What Is Simple Interest Internal Control Business Analyst Simple Interest

Financial Loan Calculator Estimate Your Monthly Payments

/f/84672/1160x565/3c7ee84a24/how-do-you-calculate-borrower-power.jpg)

How Do You Calculate Borrowing Power

Calculators Credit Calculators Credit Com

Loan Calculator That Creates Date Accurate Payment Schedules

How Much Can I Borrow Home Loan Calculator

Home Affordability Calculator Credit Karma

How Much Can I Borrow Home Loan Calculator

Where Art Thou Plot Of Dirt Residential Land Commune The Borrowers

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips